How Will The Plan Be Paid For?

If voters approve the referendum, the maintenance and improvements to our schools will be funded with a tax increase on property within our district.

If voters approve the referendum, the maintenance and improvements to our schools will be funded with a tax increase on property within our district. If you own property in our school district, your Individual tax impact will depend upon its True and Full Value, NOT its market value. The levied tax would remain in place for 20 years or until the plan is fully paid off, whichever is sooner.

The most accurate way to determine your tax impact is to use the referendum tax calculator. Download the calculator here and enter the full and true value of your property.

The tax calculator may be difficult to access on a mobile device - we recommend using a computer to view. If you have problems accessing the calculator or questions about your tax impact, please reach out to us for assistance.

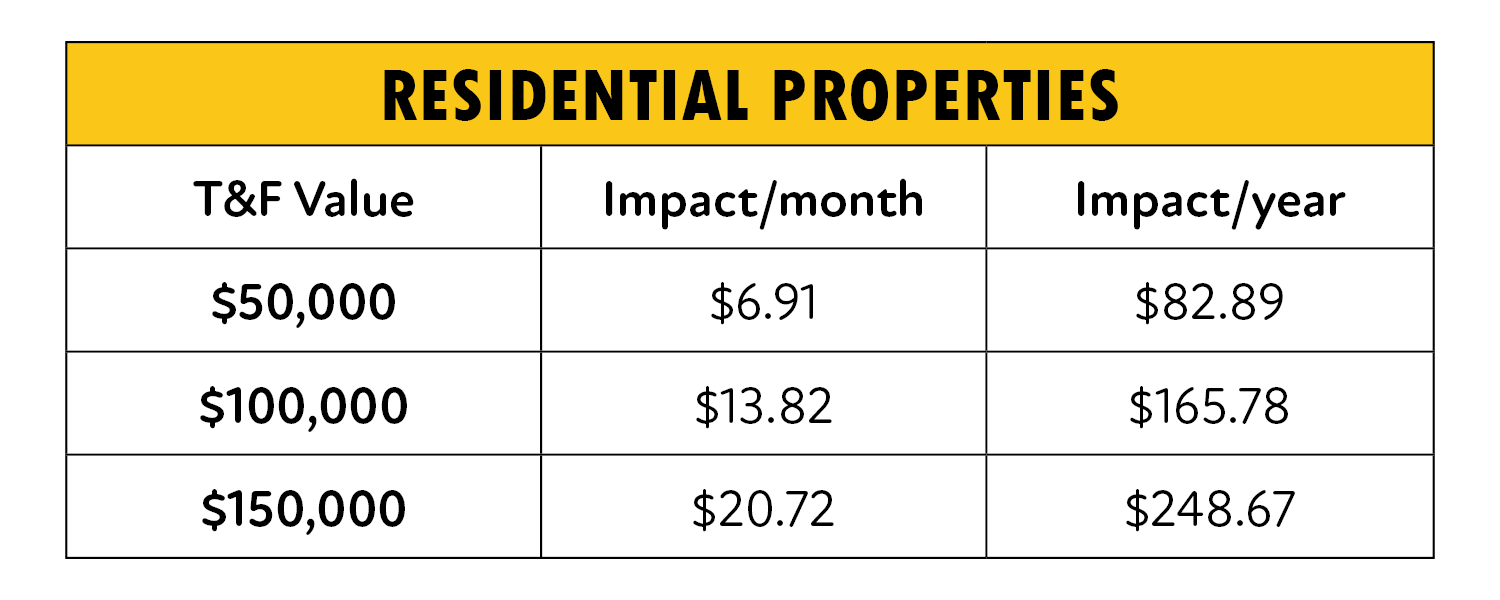

Example Tax Impacts

These tax impact amounts take into account all fees and interest associated with the bonds to complete the proposed plan. The levied tax would remain in place for 20 years or until the plan is fully paid off, whichever is sooner.

Watch this step-by-step video on how to calculate your tax impact:

Are there ways to reduce my property tax amount?

Yes! Homeowners can apply for North Dakota’s Primary Residence Credit (PRC) through the North Dakota Office of State Tax Commissioner to receive a credit of up to $1,600 against their 2026 property tax obligation. There are no age restrictions or income limitations for this credit, but you must own a home (house, mobile home, townhome, duplex, or condo) in North Dakota and reside there as your primary residence. Only one Primary Residence Credit is available per household. This credit applies to general property taxes and can be applied for regardless of an approved referendum.

This is only one of several property tax credits that property owners may qualify for. For other available credits, see the ND Tax Commissioner’s full list here.